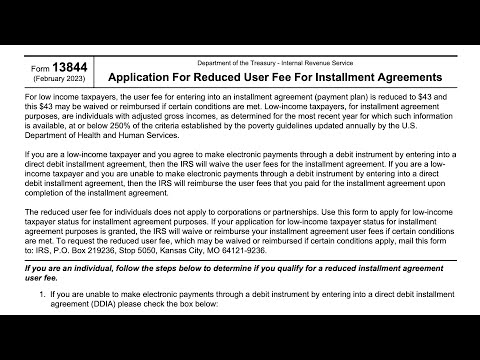

IRS Form 13844 application for reduced user fee for installment agreements so this form you most taxpayers won't use this form unless they've requested to enter into an installment agreement with the Internal Revenue Service and if that's the case and you've agreed to installment payments under an installment agreement plan then certain low income taxpayers may be able to either reduce or eliminate their user fee for entering into that installment agreement so depending on the type of agreement the length you can reduce this user fee down to forty three dollars and in certain cases this 43 dollar fee may even be waived or reimbursed as long as the taxpayer meets certain conditions so if we're going to walk through this form we're going to discuss a little bit about the eligibility criteria but so that you know this really applies to individuals with adjusted gross incomes of at or below 250 percent of the poverty level guidelines as updated by the federal government specifically the Department of Health and Human Services so if you are a low-income taxpayer and you agreed to make debit payments electronic payments through a your a debit you know arrangement then the IRS can waive the user fees for this this installment agreement if you're not able to make electronic payments but you uh you still have an installment agreement in place then the IRS can reimburse your user fees once you've completed the assault and made all the required payments under the installment agreement so this user fee application only applies to individuals there is not this is not for corporations or Partnerships or other entities it's specifically for low-income taxpayers so it's a very straightforward form if you're an individual you're just going to walk through these steps if you...

PDF editing your way

Complete or edit your form 13844 application for reduced user fee anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 13844 irsgovform form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 13844 irsgovform as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your dept decreased rev by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 13844

About Form 13844

Form 13844 is a document used by individuals who are seeking to negotiate an offer in compromise with the Internal Revenue Service (IRS). An offer in compromise allows taxpayers to settle their tax debt for less than the full amount owed, based on their ability to pay. This form is specifically designed for taxpayers who are experiencing financial hardships and are unable to pay their tax liabilities in full. It is utilized to provide detailed information about the taxpayer's financial situation, including income, expenses, assets, and liabilities. The IRS reviews this information to determine the taxpayer's eligibility and the appropriate amount to be considered for settlement. In summary, individuals who are seeking to settle their tax debts through an offer in compromise will need to complete and submit Form 13844 to the IRS.

What Is Form 13844?

Online solutions assist you to arrange your document management and enhance the productiveness of your workflow. Observe the brief manual in order to complete Form 13844, stay away from errors and furnish it in a timely way:

How to fill out a 13844 form?

-

On the website hosting the form, choose Start Now and move towards the editor.

-

Use the clues to complete the pertinent fields.

-

Include your personal details and contact details.

-

Make sure that you choose to enter accurate details and numbers in correct fields.

-

Carefully check the content in the form so as grammar and spelling.

-

Refer to Help section if you have any questions or address our Support staff.

-

Put an electronic signature on the Form 13844 printable with the support of Sign Tool.

-

Once document is completed, press Done.

-

Distribute the prepared through email or fax, print it out or save on your device.

PDF editor makes it possible for you to make alterations in your Form 13844 Fill Online from any internet linked gadget, customize it in accordance with your needs, sign it electronically and distribute in several approaches.

What people say about us

The best way to complete templates without having mistakes

Video instructions and help with filling out and completing Form 13844