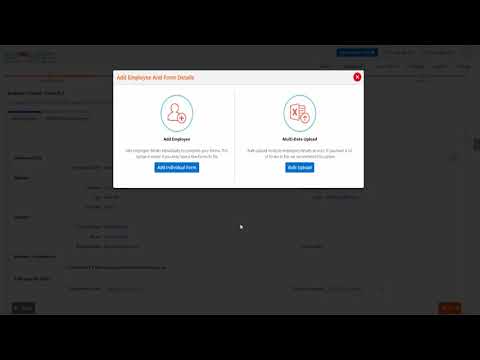

Welcome to tax bandits simplify tax efiling for small businesses and nonprofits to register for tax bandits mister wwx bandits calm and click sign in in to the necessary account information to create your account after creating your account select that you would like to create a w-2 form from your dashboard these forms are used to report wages paid to your employees now with tax bandits is easier than ever to e-file your w-2 form and remain compliant with the SSA selecting your payer or employer is the first step if you already have employer details in your address book you can auto fill the required information by selecting the employer from your records next adding employee inform details can be processed in two ways individually or by bulk upload to add an employee individually you must enter their name social security number and address proceed to the employee page to begin entering each employee's federal details following federal details you'll need to enter each employees state details select the state into the employer state ID number state wages and income tax and other valued information then proceed to the summary of your completed form notice only one form is present for this employer to add another employee's form w2 click Add form for this payer select w2 and repeat this process until you have entered all the employees federal and state details now continue to choose how you wish to file these forms you can choose between federal filing only or package which includes federal and state efiling along with postal mail after your selection if you chose to electronically file Form w2 with the state tax pan this will prfurther instructions on the necessary state requirements now at this point you're reaching the end of each filing...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Irs Form 13844 Payroll