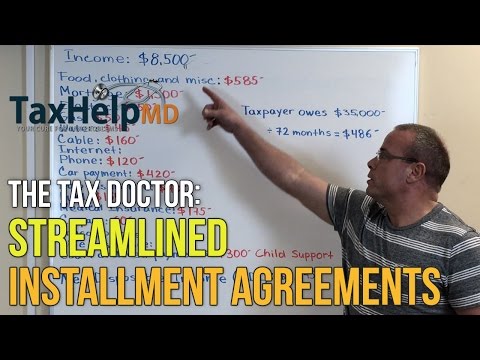

Hi, my name is Dean Michael, the CEO and founder of Tax Help MD. I want to address a common issue that many people face when dealing with tax debt. Often, individuals feel ashamed or embarrassed about their situation, leading them to procrastinate seeking help. However, it's important to understand that nobody wakes up in the morning and decides to have a tax debt. It can arise due to various circumstances such as going through a divorce, experiencing a death in the family, losing employment, or mismanaging a business. The truth is, you are not alone. 1 out of every 3 people in our country has a tax problem. So, don't let embarrassment be the reason why you don't seek help. Step up and get the assistance you need. You'll be glad you did. In our previous videos, we discussed NDI (Negative Net Disposable Income) and having a minimal NDI. However, what if you're making good money and don't have a financial hardship that can be presented to the IRS? If you owe under $50,000, there's no need to present financials to the IRS. We have a solution called the streamlined installment agreement. Under this program, we divide the amount owed by 72 months, without considering interest and penalties. It's a great program that can help you manage your tax debt effectively. Let me illustrate an example. Imagine a taxpayer with an income of $8,500. After subtracting necessary living expenses, they have a positive NDI of $4,745. However, it's important to note that we wouldn't want to show the IRS this amount as they would request the full $4,745. If you don't have to show them financials, then the streamlined installment agreement is the way to go. Simply take your debt, as long as it's under $50,000, and divide it by 72...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Irs Form 13844 Pending