One of the main areas that are audited is charitable donations. Some of the things that you can do if charitable donations are included in your audit are to make sure that you prepare when you're preparing your return and keep the proper documentation and receipts. You want to make sure that you have a list of all the items that you're donating to the charitable organization so that list can be taken to the IRS audit. On that list, you want to make sure that you have the type of item it was and its value. For example, if it's hardback books or paperback books, and how many books you gave. If it's a collector set of books, that would have a different value. In terms of documentation for your IRS audit, you need to substantiate the deduction you've taken. Instead of just saying you gave away 10 bags of clothes, you need to specifically enumerate what's in those bags. It may be grocery bags or large trash bags, which can have a very different deduction value. Similarly, instead of just saying you gave a couch to Goodwill, you need to describe that couch. It could be a fine leather Italian couch or a rather tattered old couch that's been passed down in the family and doesn't have significant economic value. To further support your deductions, you might consider taking pictures of your donations, especially if they are large in dollar amount. So, if you are audited, what you need to take to that IRS audit is your list, the value you determined, and pictures of those items if you have them, which would always be helpful.

Award-winning PDF software

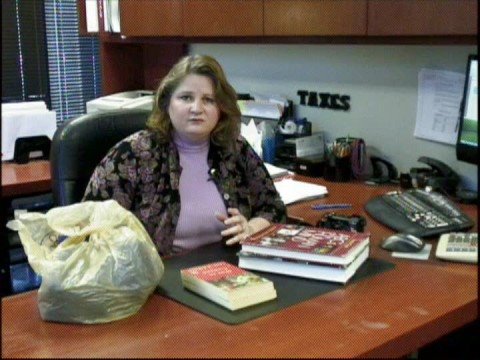

Video instructions and help with filling out and completing Can Irs Form 13844 Charities