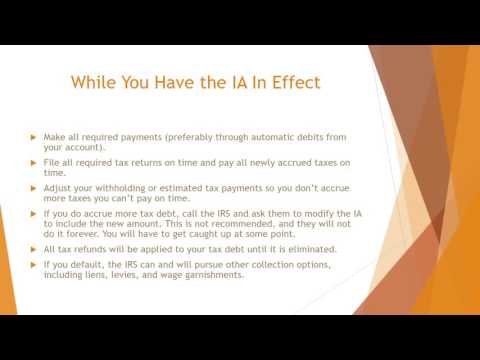

Everybody, this is Rebecca Brown again, from Rebecca Brown Tax Consulting. Today, I am here to talk with you about IRS installment agreements. Installment agreements, commonly referred to as IA, are the most commonly used tool that helps taxpayers resolve their tax debts. They are easy to qualify for, making them accessible to most people. With an installment agreement, you will pay a portion of your taxes, penalties, and interest owed to the IRS until your debt is paid in full. It's akin to taking out a loan from the federal government, as you will need to provide detailed financial information. There are two kinds of installment agreements - streamlined and non-streamlined. In this presentation, I will focus on the streamlined version, as most taxpayers qualify for it. To qualify for a streamlined installment agreement, you must owe less than $50,000 in combined taxes, interest, and penalties. For businesses, this limit drops to $25,000, as payroll taxes are considered a priority for collection by the IRS. Additionally, you must have filed all necessary tax returns before applying for the IA. You can file the installment agreement form simultaneously with your tax returns. However, you must not have had an IA in the past five years, and you can't have enough available funds to pay the full amount due immediately. If you do not qualify for a streamlined IA, don't panic. There is a non-streamlined version available, although it is more difficult to obtain. To apply for an installment agreement, you must file all missing tax returns. Once completed, you can submit the form, known as the installment agreement request or Form 9465. You can mail it or, in some cases, file it online. Calculating your installment payments involves dividing your total owed amount by 72, as the maximum repayment period...

Award-winning PDF software

Video instructions and help with filling out and completing Can Irs Form 13844 Blog