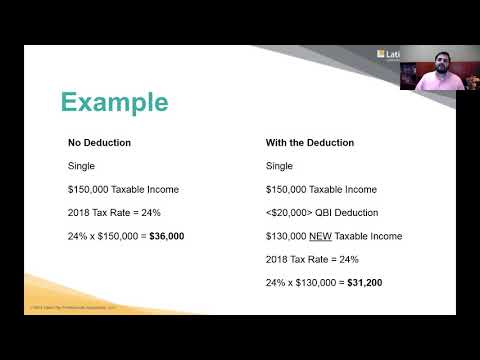

Hi everyone, thank you for being with us. The purpose of today is to give you a good overview of the 20% Section 199A deduction, specifically related to Schedule C. Understanding Schedule C is important to understanding the entire new law, as it can become complicated when looking into S corporations, partnerships, and other areas. We are recording this presentation and will offer it live on YouTube and Facebook for you to view at a later time. The purpose of today's presentation is to cover who qualifies for the 20% deduction, limitations as your profit increases, tax planning strategies to increase the deduction, easy to understand examples, and an open question and answer session. Section 199A allows taxpayers, other than C corporations, a deduction of 20% of qualified business income. The first step is to calculate qualified business income, and then you can take up to a 20% deduction based on that income. However, the qualified business income must be earned as a qualified trade or business, with certain limitations. The deduction only applies to income tax and does not apply to self-employment tax. The benefits of the Section 199A deduction include reducing tax liability. However, there are complexities and limitations depending on factors such as income and type of business. As tax professionals, we can assist clients with navigating these complexities. There are three major concepts to understand. First, the deduction applies to pass-through entities such as sole proprietorships, partnerships, S corporations, real estate investment trusts, and rental activities. Second, there are income thresholds of $157,500 for individuals and $315,000 for married couples that determine if you qualify or if other limitations apply. Qualified business income includes the net amount of income, gain, deduction, and loss related to a qualified trade or business, excluding certain types of income such...

Award-winning PDF software

Video instructions and help with filling out and completing Who Irs Form 13844 Pros