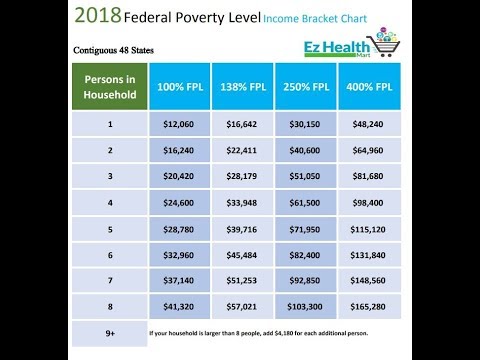

Here is the corrected version: How to use the 2018 federal poverty level chart? Let's start with understanding what the federal poverty level chart is. You probably heard this as the FPL chart. It's established by the government as the minimal amount of gross income needed for food, clothing, transportation, shelter, and other necessities of a family. This chart does vary based on family size. The FPL chart is used as the criterion threshold for eligibility to many benefit programs, including Obamacare, Medicare, Medicaid, and CHIP. In 2018, the numbers have been adjusted, and you can see them on our website listed in the description. The goal of the FPL chart is to find your percentage on the chart. 100 percent is the bare minimum for living needs, as the chart reads. If you are single, twelve thousand sixty dollars per year is the bare minimum. If you have two people in the household, sixteen thousand two hundred forty per year is one hundred percent. Let's use an example, as it won't always be this simple. Always refer to the 100 percent bracket during this following equation. Let's say you are single, making fourteen thousand sixty dollars a year. Take your income and divide it by the 100 percent bracket for single households. It would be twelve thousand sixty dollars. This will leave you with a decimal. Your decimal amount is a percentage. In this case, we have one point one six, which is translated to one hundred and sixteen percent. This is how you find your spot on the FPL chart. If you have a household of three making forty-eight thousand dollars a year, dividing by twenty thousand four hundred twenty, your decimal would be two point three five. This means you would be at two hundred thirty-five percent on the federal poverty...

Award-winning PDF software

Video instructions and help with filling out and completing When Irs Form 13844 Poverty