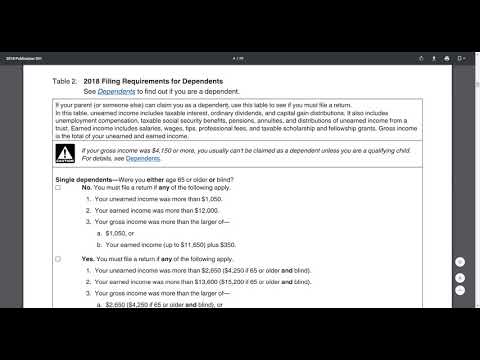

Good morning, everyone! This is a Met City CPA, and I'm doing another two-minute tax topic video. These videos are intended to be short and get right to the point. Today, I'm looking at the IRS Publication 501, specifically discussing filing requirements for dependents. If you are a dependent, the IRS has a wonderful table in their publication that talks about whether or not you need to file a return. Before we get started, I want to give a shoutout. Please, if you love God, hit subscribe if you enjoy or find this video helpful. Now, let's get started. Here's the table. It says, "If someone can claim you as a dependent, use this table to see if you must file a return." In this table, unearned income includes taxable income, ordinary dividends, capital gains distribution, unemployment compensation, taxable social security pensions, annuities, and distributions. Earned income from a trust includes salary, wages, tips, professional fees, and taxable scholarship and fellowship grants. Gross income is the total of your unearned income and earned income. For gross income, if your gross income was $4,150 or more, you usually can't be claimed as a dependent unless you are a qualifying child. This is a little stipulation. Assuming you haven't been excluded yet, the first question is: Are you married or single? The table further asks if you are over 65 or blind. It narrows down the options until it reaches a yes or no answer. If you need to file a return. Here it states that your gross income was at least $5, so it gets down to a very small, neat amount. This is the Met City CPA two-minute tax topic. I'll include a link below. Please, subscribe.

Award-winning PDF software

Video instructions and help with filling out and completing What Irs Form 13844 Topic