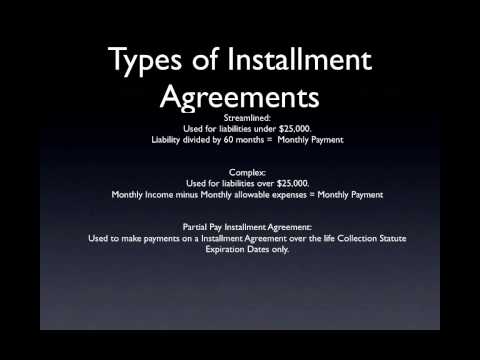

Pi RS installment agreements answers to your questions. Hi, my name is Darren Mesh and I'm an attorney who practices in Tampa, Florida. We represent clients nationally and internationally with their problems with the IRS. I'm here today to answer some common questions people have about IRS installment agreements. What are they? How do you get one? Are there different types? Do I have to fully pay how much I owe to the IRS? How long can I get one for and those types of questions? Well, there are basically three types of installment agreements, in my opinion. There's something called a streamlined installment agreement, which I'll explain in a minute. Then, there's one called a complex installment agreement, and lastly, there's something called a partial pay installment agreement. First, the streamlined installment agreement. It's called streamline because if you owe under $25,000 and meet certain conditions, you can get a streamlined installment agreement. I won't go into all the conditions now, but if you owe under $25,000 and can pay it off over 60 months, then you can qualify for a streamlined installment agreement. Let me give you some numbers. If you owe $25,000 and want to pay it off over 60 months, the monthly payment will be approximately $450. That's not including penalties and interest. To full pay it, you'll want to offer around $500 a month. That's what's called a streamlined installment agreement. Next is the complex installment agreement. I'm the only one I've ever heard call it that. If you owe over $25,000, it's much harder to get an installment agreement. You'll have to justify what you can afford to pay. You'll need to fill out a collection information statement and negotiate with the IRS over your monthly payment. If they think your ability to pay is $1,200 a month,...

Award-winning PDF software

Video instructions and help with filling out and completing Irs Form 13844 Agreements