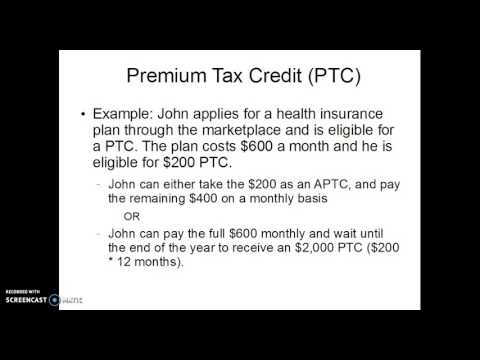

Let's take a look at the Affordable Care Act and how it impacts individual tax returns. We're just gonna look at the framework of this, again, how it impacts tax returns. We're not going to be looking at actual calculations or the tax forms in this video. If you understand the framework, the rest is pretty simple, especially after you do the reading. So, the Affordable Care Act prohibits insurance companies from denying coverage or charging higher premiums for individuals with prior conditions, which they could in the past. This raises costs for the insurance companies, and one of the ways to make this work is by making sure everyone buys insurance because then it creates a larger insurance pool, kind of mitigating the cost and spreading it over a larger pool. So, in general, all taxpayers should have health insurance, and more specifically what is called minimum essential coverage. This is defined in the reading but it is not dental insurance, vision insurance, or any supplemental type of plan, which covers minimum essential coverage. An easy way to think of that is it's an employer-sponsored health insurance plan or an individual health insurance plan that a taxpayer may purchase or even a governmental plan like Medicaid or Medicare. These things are minimum essential coverage. Now, you're gonna look at this in a manner where we're gonna separate it where a taxpayer either had minimum essential coverage for the full entire year, or they did not have the minimum essential coverage for the full entire year. So, we'll first look at a situation where a taxpayer had minimum essential coverage all year. Taxpayers can purchase or get minimal essential coverage through one of these three sources. There may be others, but these are three main sources: generally health insurance is obtained through an employer-sponsored...

Award-winning PDF software

Video instructions and help with filling out and completing Irs Form 13844 Affordable