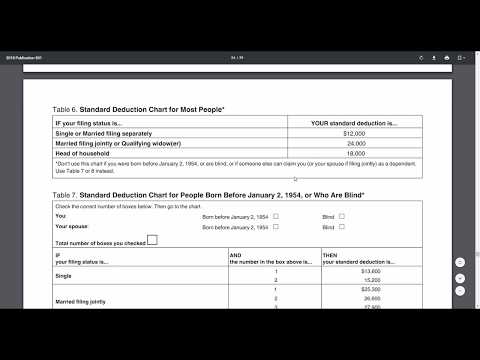

Good morning, everyone! This is the Med City CPA, and we are doing another 2-minute tax topic video. This one's specific for whether you should itemize or take a standard deduction. We're really emphasizing what the standard deduction is, so before we get started, please, for the love of God, hit subscribe. That would be wonderful and fantastic. We're trying to get this channel up and running, aiming for a thousand subscribers. So here we go. The standard deduction is a topic that many people have considered. In the past, people would often debate whether they should itemize their deductions, listing everything out and giving it to the IRS, or simply take the lump sum amount provided by the IRS. However, for the tax filing year 2018, the IRS has increased the standard deduction, making it a more attractive option for most individuals. For example, if you are filing as single or married filing separately, you can claim a standard deduction of $12,000. If you are married filing jointly or a qualifying widower, the standard deduction is $24,000. Finally, if you are the head of household, you can claim a standard deduction of $18,000. These amounts have significantly increased compared to previous years. It's worth noting that there is also a standard deduction chart for individuals born before 1954 who are blind, which may give them an extra boost. As I'm looking at the IRS Publication 501, I find it interesting that they increased the standard deduction. However, this may come as a surprise to many individuals who have been accustomed to collecting and providing numerous receipts for their deductions over the years. They may now find that their deductions are much less than the standard deduction. So, in conclusion, it seems that for the majority of taxpayers, the standard...

Award-winning PDF software

Video instructions and help with filling out and completing How Irs Form 13844 Topic