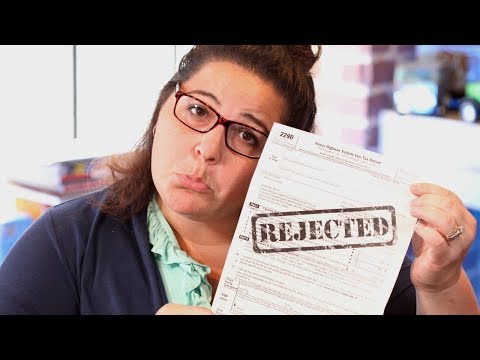

Hi everyone, it's Express Amber. I'm over on Express Truck Texas page again. I'm like overhauling it with another top reasons video. Today we're going to talk about the top reasons for rejections. The name does not match the EIN. This is probably the number one reason for your 2290 being rejected. I've said it before and I'll say it again, the name that you register your EIN with the IRS has to be the name that you register your 2290 with. So when we ask for the owner or the business name, that name has to match the EIN that the IRS has on file. So if you register your EIN with the business name, you have to file your 2290 under a business name. If you register it with your personal name, again you have to file your 2290 under your personal name filing with your social security number. The IRS does not allow taxpayers to use their SSN to file for their 2290. They now require you to have an Employer Identification Number to file the 2290. So if you file with your social, it will be rejected. A brand new EIN. When you get your EIN number, the IRS will tell you that it's active and that you can open a bank account and you can do all these sorts of different things with your EIN. The one thing that you cannot do right away is e-file a tax return until the number is active in the IRS system, which can take up to ten business days. The e-file will be rejected because the number is not in their system to match it. So if you have a brand-new EIN and you efile a 2290 and it's rejected, you can come back into Express Truck Tax every...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Irs Form 13844 Rejection