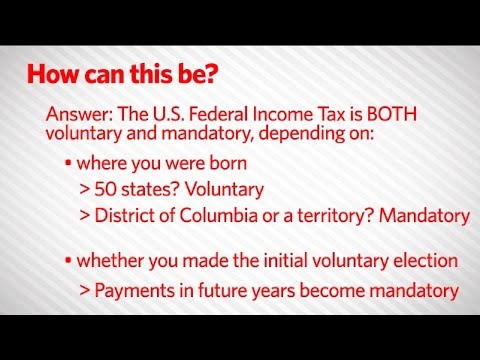

WAIS and Associates presents. How can the federal income tax be voluntary? Contrary to popular belief, participation in the US federal income tax scheme is voluntary to a vast majority of Americans. It's basically an accepted custom that most Americans never think to even ask basic questions about, especially in regard to the jurisdiction to which the federal income tax scheme is only directed as a result of the 16th amendment. Here's a brief clip of then IRS commissioner Stephen Miller, who makes a clear admission during a congressional hearing back in 2013. This mirrors the sworn testimony provided by Dwight Abus in 1953 when the IRS chief stated to the House Ways and Means Committee that the income tax was 100% voluntary and the liquor tax was 100% enforced. It may come as a shock to many Americans who have difficulty grasping the concept that the federal income tax is both voluntary and mandatory. The federal income tax is voluntary for American nationals, those born in one of the 50 states of the Union, and mandatory for statutory US citizens born in federal territory. It must be understood that the national government wants to keep you in their club for as long as possible, so it's not surprising that they, at times, will not divulge the total picture of who is liable to pay the tax and who is not. For Americans who are born and currently reside and work in the constitutional republic, they aren't naturally subject to the income tax because of the US Supreme Court Pollak decision in 1895. However, those Americans often make a voluntary election to be taxed, whether they do so knowingly or not. And when they do, they're viewed by the national government as US resident aliens. Once they volunteer, subsequent payments become...

Award-winning PDF software

Video instructions and help with filling out and completing Can Irs Form 13844 Voluntary