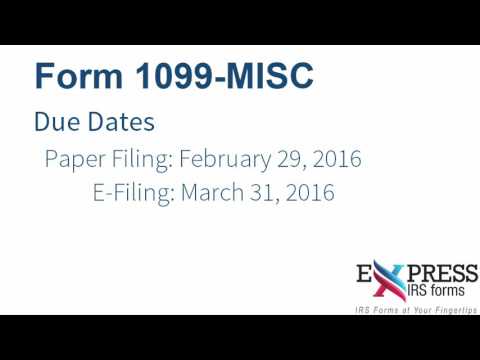

Welcome to Express IRS forms. Form 1099-MISC, for miscellaneous income, is used to report payments for services provided for a business by people not treated as its employees, such as payments to subcontractors, rent payments, or prizes. A 1099-MISC form must be provided to the recipient and a copy emailed to or e-filed with the IRS. The due date for filing Form 1099-MISC is February 29, 2016. If you choose to e-file Form 1099-MISC, the due date is automatically extended to March 31st, 2016. Please keep in mind that recipients must be provided a copy by February 1st, 2016. SAR Form 1099-MISC is used for each person to whom during the year was paid at least ten dollars in royalties or broker payments in lieu of dividends or tax-exempt interest, at least six hundred dollars in rent, services, prizes, other income payments, medical and health care payments, and insurance proceeds, or generally, the cash paid from a notional principal contract to an individual, partnership, or estate. Any fishing proceeds or gross proceeds of $600 or more paid to an attorney. The IRS encourages filing for this information return and mandates that anyone found in 250 or more must file the returns electronically. To learn more about how you can e-file your information returns, such as Form 1099-MISC, with the IRS, you can go to Express IRS forms com. If you have any questions regarding filing, contact our dedicated customer support team at 704-839-2270 or send them an email at support@ExpressIRSforms.com.

Award-winning PDF software

Video instructions and help with filling out and completing Can Irs Form 13844 Miscellaneous