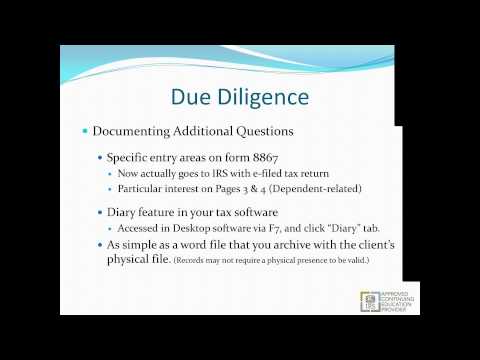

The broadcast is now starting. All attendees are in listen-only mode. Okay, my name is Derek North and I'm a rolled agent and premiere account executive here at Federal Direct Tax Services. Today, we're going to be going over our tax preparer ethics and Circular 230. It's going to cover who can practice before the IRS, the our TRP and EI requirements, continuing education details, renewal details for your various certificates and authorizations, and due diligence when it comes to actually preparing tax returns. What is Circular 230? Circular 230 is the common name for what's called the Treasury Department Circular number 230 regulation governing practice before the Internal Revenue Service. This document defines the registration requirements for various classes of tax professionals and a few other financial professionals that we're not going to cover too much in this particular webinar. It also outlines the rules, penalties, and continuing education requirements for all professional designations licensed to practice before the IRS or subject to what the IRS calls the Office of Professional Responsibility (OPR). Circular 230 forms the basis for most ethical considerations regarding tax practice. It covers everything you can get in trouble for, the rules, and all other related information. It lets you know who's responsible, who's subject to various penalties, and what your requirements are as a preparer. One of the first things that Circular 230 does is outline who can practice before the IRS. There are only a handful of individuals that are actually capable of practicing before the IRS, and they are the following: enrolled agent (federally tax-related), certified public accountants, enrolled retirement plan advisors, enrolled actuaries, and attorneys licensed to practice within their particular state. The IRS has the power to regulate those who can practice before them by determining their character, reputation, qualifications, and general...

Award-winning PDF software

Video instructions and help with filling out and completing Can Irs Form 13844 Circular